Protecting Your Business at Every Stage

Brooks Audit offers a full suite of Tax and Legal services to support your business’s regulatory compliance, corporate structuring, and financial transparency. Whether you’re launching a new entity, navigating VAT regulations, or enhancing governance, our expert team delivers tailored solutions with a deep understanding of local and international requirements.

Corporate Legal Services

At Brooks Audit, we offer a comprehensive range of corporate legal services to support businesses throughout their lifecycle — from formation and registration to governance and compliance. Our legal experts provide practical, commercially sound advice tailored to the regulatory landscape in Bahrain and the broader GCC region. Whether you’re launching a new venture, expanding operations, or strengthening internal controls, we help you stay protected, compliant, and strategically positioned for success.

Business Entity Formation

We assist clients in selecting the right business structure based on legal, tax, and operational needs. Our services include strategic advice on company types (W.L.L., PARTNERSHIP, B.S.C., etc.), shareholding arrangements, and governance frameworks to ensure a strong legal foundation.

Company Registration

Our team manages the full lifecycle of company incorporation — from name reservation and licensing to commercial registration and document notarization. We ensure a smooth and compliant setup process with the Ministry of Industry and Commerce in Bahrain and other relevant authorities.

Contractual Support

We draft, review, and negotiate commercial agreements to protect your business interests. Our legal advisors ensure your contracts are compliant, clearly structured, and risk-aware — whether for partnerships, services, employment, or supply chain relationships.

Regulatory Compliance

We help businesses stay aligned with Bahrain’s evolving legal landscape, including MOIC, LMRA, and other regulatory bodies. Our compliance services cover license renewals, filings, reporting obligations, and general corporate housekeeping to reduce risk and avoid penalties.

Corporate Governance Services

Strong governance is key to long-term success. We provide comprehensive corporate governance support for boards, executive teams, and shareholders — ensuring accountability, transparency, and compliance.

We evaluate existing governance frameworks, identifying strengths, gaps, and opportunities for improvement. This includes assessments of board effectiveness, committee structure, and governance practices.

We support board development by advising on composition, responsibilities, and performance evaluations. We also assist with induction programs and ongoing governance training.

Our team develops and reviews governance-related documents, such as board charters, codes of conduct, and policy manuals — ensuring alignment with best practices and regulatory standards.

We assess your risk environment and internal controls, helping you build or enhance enterprise risk management (ERM) frameworks and control systems.

We offer expert guidance on corporate governance laws, disclosure obligations, and transparency standards in Bahrain and internationally.

We assist with shareholder engagement strategies, proxy management, and general meeting preparations — supporting smooth, compliant stakeholder interactions.

Our team advises on executive pay structures, aligning incentive plans with shareholder expectations and governance norms.

Anti-Money Laundering (AML) Services

We offer specialized AML services to help businesses combat financial crime, meet regulatory obligations, and build strong internal compliance frameworks.

We perform comprehensive audits of AML policies, procedures, and internal controls to assess their effectiveness and ensure alignment with applicable regulations.

Our team identifies and evaluates AML risks across customer profiles, geographic operations, and product/service offerings. We help develop risk-based approaches to mitigation.

We assist in building robust AML programs, including policies, transaction monitoring systems, and due diligence protocols that meet both local and international standards.

We deliver customized training programs to educate your team on AML obligations, red flags, and reporting procedures — strengthening organizational awareness and readiness.

We review and enhance your transaction monitoring processes, including system configuration, alert analysis, and investigative procedures to improve detection capabilities.

We help implement or refine Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) processes to ensure proper client verification and risk-based ongoing monitoring.

Our experts provide ongoing advisory services to help you keep pace with AML legislation, stay audit-ready, and maintain regulator trust.

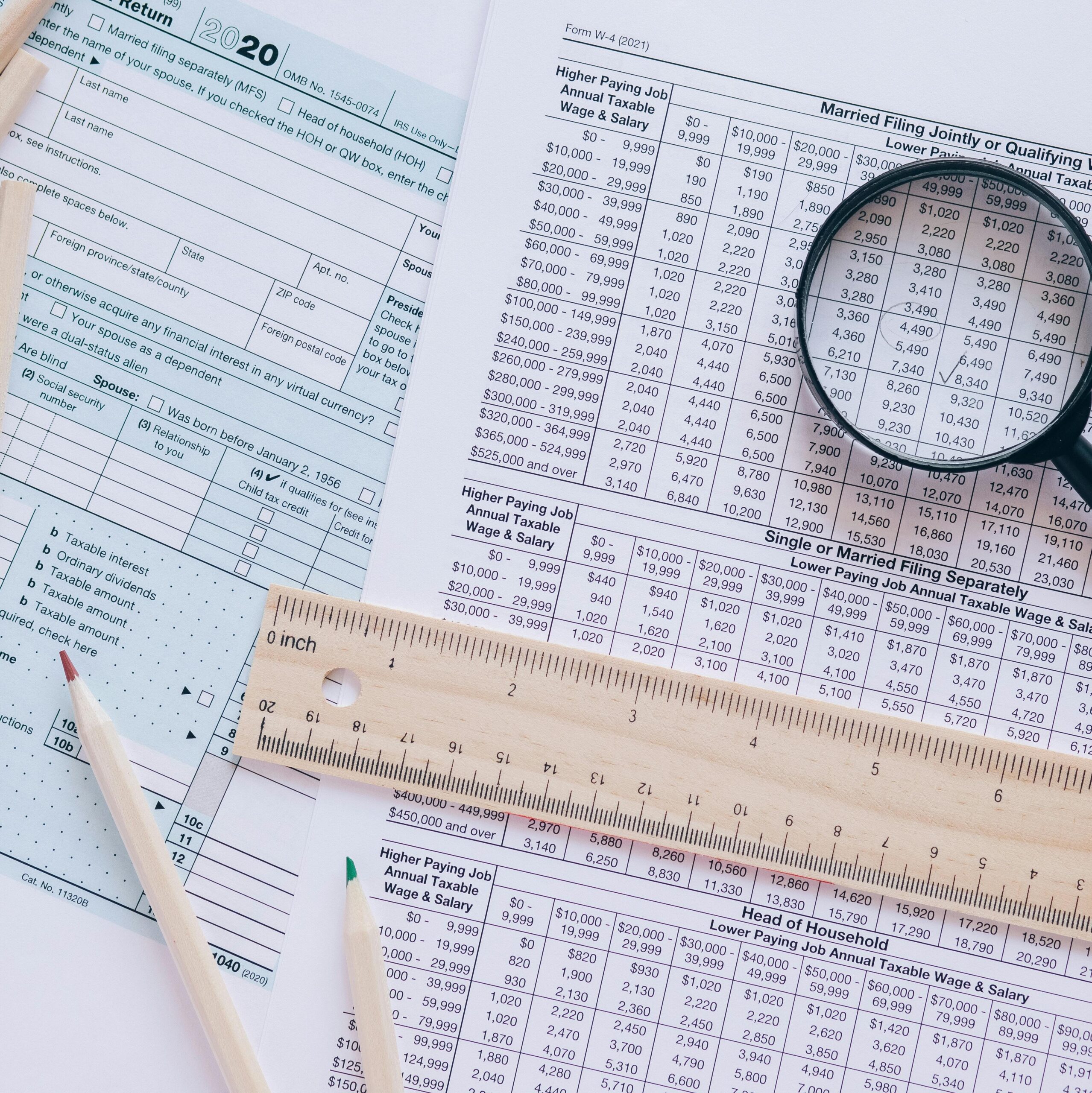

Tax Services

Our Tax Services focus on helping businesses manage their VAT obligations efficiently, reduce tax risks, and maximize compliance with Bahrain’s VAT laws.

VAT Registration

We guide businesses through the VAT registration process, ensuring timely submission of accurate documentation and liaison with the National Bureau for Revenue (NBR).

VAT Implementation

Our implementation services cover everything from revising accounting systems to training staff on VAT-compliant procedures. We ensure your internal processes meet the standards set by tax authorities.

VAT Compliance

We manage your VAT return preparation and filing, help maintain accurate VAT records, and ensure compliance with all regulatory timelines and requirements.

VAT Advisory

We provide expert analysis of complex VAT scenarios, including cross-border transactions, supply chains, and VAT optimization strategies tailored to your business operations.

VAT Audits and Investigations

Our team helps you prepare for NBR audits and respond to inquiries or disputes. We represent your business and ensure your documentation supports a favorable outcome.

VAT Training

We offer in-house and virtual training programs for your staff on VAT regulations, invoicing requirements, documentation standards, and common pitfalls to avoid.

VAT Recovery

We help ensure your business maximizes its eligible input VAT recovery — reducing tax costs and improving cash flow through proper documentation and strategic planning.